「全世界へ分散」がウリでもあり弱点でもあるETF,VT(バンガード・トータル・ワールド・ストック)

「投信ブロガーが選ぶ!Fund of the Year」では常に上位にランキングされている人気のETFです.

最近では,楽天証券がこのVTを買い付ける投資信託「楽天・全世界株式インデックスファンド」を発売し,今後ますます大きなETFに成長していくと思われます.

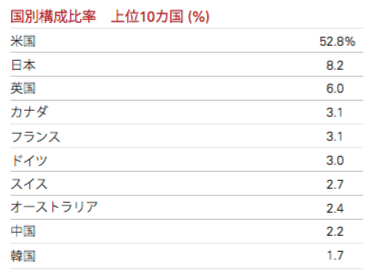

VTの国別構成比率では,日本が8.2%と米国に次いで2位となっています.

Vanguard社の投資のプロはいったいどんな日本株を買っているのでしょうか?

組み入れ上位500社に含まれる日本株を調べてみました.

(注:上位200銘柄一覧を書き出しましたので長ーくなっています.どの銘柄が含まれているかだけに興味がある方は,下の「もくじ」から飛んでください)

VT保有銘柄

VTが保有する銘柄数は,7825銘柄(2017/8/31)

そのうち上位 200銘柄一覧を書き出しました.

順位,銘柄,株数,時価総額を表示しています.

赤字が日本株です.

|

順位 |

銘柄 | 株数 | 時価総額 |

| 1 | Apple Inc. | 1,398,494 | $229,353,016 |

| 2 | Microsoft Corp. | 2,001,204 | $149,630,023 |

| 3 | Facebook Inc. Class A | 623,215 | $107,174,284 |

| 4 | Amazon.com Inc. | 106,196 | $104,135,798 |

| 5 | Johnson & Johnson | 720,268 | $95,341,875 |

| 6 | Exxon Mobil Corp. | 1,129,084 | $86,182,982 |

| 7 | JPMorgan Chase & Co. | 942,823 | $85,693,182 |

| 8 | Alphabet Inc. Class A | 81,905 | $78,238,932 |

| 9 | Alphabet Inc. Class C | 78,309 | $73,557,993 |

| 10 | Nestle SA | 830,587 | $70,413,799 |

| 11 | Berkshire Hathaway Inc. Class B | 355,798 | $64,456,366 |

| 12 | Bank of America Corp. | 2,664,652 | $63,658,536 |

| 13 | Procter & Gamble Co. | 679,789 | $62,724,131 |

| 14 | AT&T Inc. | 1,650,671 | $61,834,136 |

| 15 | Wells Fargo & Co. | 1,200,840 | $61,326,899 |

| 16 | Tencent Holdings Ltd. | 1,436,556 | $60,449,809 |

| 17 | General Electric Co. | 2,324,623 | $57,069,495 |

| 18 | Chevron Corp. | 504,075 | $54,248,552 |

| 19 | Pfizer Inc. | 1,578,952 | $53,558,052 |

| 20 | Novartis AG | 628,031 | $52,947,507 |

| 21 | Verizon Communications Inc. | 1,095,829 | $52,566,917 |

| 22 | HSBC Holdings plc | 5,363,874 | $52,001,737 |

| 23 | Comcast Corp. Class A | 1,256,900 | $51,042,709 |

| 24 | UnitedHealth Group Inc. | 255,457 | $50,810,397 |

| 25 | Visa Inc. Class A | 489,335 | $50,655,959 |

| 26 | Citigroup Inc. | 734,226 | $49,949,395 |

| 27 | Philip Morris International Inc. | 415,291 | $48,559,977 |

| 28 | Home Depot Inc. | 320,516 | $48,035,733 |

| 29 | Merck & Co. Inc. | 729,881 | $46,610,201 |

| 30 | Roche Holding AG | 183,360 | $46,586,420 |

| 31 | Coca-Cola Co. | 1,012,188 | $46,105,163 |

| 32 | Samsung Electronics Co. Ltd. GDR | 42,975 | $44,310,266 |

| 33 | Intel Corp. | 1,255,938 | $44,045,746 |

| 34 | PepsiCo Inc. | 376,703 | $43,595,838 |

| 35 | Cisco Systems Inc. | 1,335,489 | $43,016,101 |

| 36 | Walt Disney Co. | 416,630 | $42,162,956 |

| 37 | Toyota Motor Corp. | 698,194 | $39,311,241 |

| 38 | Oracle Corp. | 766,969 | $38,601,550 |

| 39 | Boeing Co. | 151,867 | $36,396,445 |

| 40 | Amgen Inc. | 196,932 | $35,008,602 |

| 41 | McDonald's Corp. | 218,059 | $34,882,898 |

| 42 | Mastercard Inc. Class A | 247,859 | $33,039,605 |

| 43 | International Business Machines Corp. | 229,329 | $32,800,927 |

| 44 | Altria Group Inc. | 517,106 | $32,784,520 |

| 45 | AbbVie Inc. | 425,445 | $32,036,009 |

| 46 | Taiwan Semiconductor Manufacturing Co. Ltd. ADR | 858,352 | $31,733,273 |

| 47 | 3M Co. | 153,852 | $31,435,041 |

| 48 | British American Tobacco plc | 498,143 | $31,076,934 |

| 49 | Royal Dutch Shell plc Class B | 1,105,048 | $30,842,762 |

| 50 | Wal-Mart Stores Inc. | 386,348 | $30,162,188 |

| 51 | TOTAL SA | 580,192 | $30,104,928 |

| 52 | Royal Dutch Shell plc Class A | 1,088,819 | $30,006,814 |

| 53 | BP plc | 5,137,217 | $29,674,703 |

| 54 | Medtronic plc | 363,360 | $29,294,083 |

| 55 | Gilead Sciences Inc. | 349,138 | $29,226,342 |

| 56 | Celgene Corp. | 206,865 | $28,739,754 |

| 57 | Royal Bank of Canada | 387,007 | $28,722,970 |

| 58 | Berkshire Hathaway Inc. Class A | 105 | $28,502,250 |

| 59 | Bayer AG | 220,767 | $28,296,835 |

| 60 | Sanofi | 287,025 | $27,985,318 |

| 61 | Commonwealth Bank of Australia | 461,256 | $27,866,453 |

| 62 | Honeywell International Inc. | 200,385 | $27,707,234 |

| 63 | Broadcom Ltd. | 106,737 | $26,905,196 |

| 64 | Bristol-Myers Squibb Co. | 442,462 | $26,760,102 |

| 65 | Siemens AG | 203,145 | $26,593,784 |

| 66 | Toronto-Dominion Bank | 494,041 | $26,530,842 |

| 67 | Naspers Ltd. | 114,244 | $25,879,586 |

| 68 | NVIDIA Corp. | 152,630 | $25,861,627 |

| 69 | GlaxoSmithKline plc | 1,299,285 | $25,777,688 |

| 70 | Allianz SE | 119,222 | $25,552,670 |

| 71 | SAP SE | 238,862 | $25,069,244 |

| 72 | AIA Group Ltd. | 3,250,782 | $25,036,879 |

| 73 | Unilever NV | 416,668 | $24,806,262 |

| 74 | Priceline Group Inc. | 13,120 | $24,299,290 |

| 75 | Banco Santander SA | 3,704,173 | $24,142,108 |

| 76 | Anheuser-Busch InBev SA/NV | 202,343 | $23,963,927 |

| 77 | Schlumberger Ltd. | 370,559 | $23,534,202 |

| 78 | BASF SE | 242,322 | $23,504,840 |

| 79 | United Technologies Corp. | 194,401 | $23,273,688 |

| 80 | Abbott Laboratories | 449,568 | $22,900,994 |

| 81 | Novo Nordisk A/S Class B | 478,576 | $22,804,060 |

| 82 | Union Pacific Corp. | 215,339 | $22,675,197 |

| 83 | Westpac Banking Corp. | 897,377 | $22,333,529 |

| 84 | Dow Chemical Co. | 332,237 | $22,143,596 |

| 85 | Diageo plc | 660,203 | $22,082,626 |

| 86 | Goldman Sachs Group Inc. | 97,983 | $21,922,716 |

| 87 | BNP Paribas SA | 288,327 | $21,921,126 |

| 88 | US Bancorp | 424,908 | $21,776,535 |

| 89 | Accenture plc Class A | 164,920 | $21,564,939 |

| 90 | Texas Instruments Inc. | 259,888 | $21,523,924 |

| 91 | Eli Lilly & Co. | 260,267 | $21,157,104 |

| 92 | Charter Communications Inc. Class A | 53,056 | $21,144,938 |

| 93 | China Construction Bank Corp. | 23,986,206 | $21,103,212 |

| 94 | Mitsubishi UFJ Financial Group Inc. | 3,463,120 | $21,102,706 |

| 95 | CVS Health Corp. | 271,150 | $20,970,741 |

| 96 | United Parcel Service Inc. Class B | 183,046 | $20,933,141 |

| 97 | QUALCOMM Inc. | 395,929 | $20,695,209 |

| 98 | Starbucks Corp. | 376,649 | $20,662,964 |

| 99 | Time Warner Inc. | 203,937 | $20,618,031 |

| 100 | Allergan plc | 89,842 | $20,616,942 |

| 101 | Lockheed Martin Corp. | 66,831 | $20,409,519 |

| 102 | Vodafone Group plc | 7,104,647 | $20,331,572 |

| 103 | Walgreens Boots Alliance Inc. | 248,193 | $20,227,730 |

| 104 | Adobe Systems Inc. | 130,224 | $20,205,556 |

| 105 | AstraZeneca plc | 340,515 | $19,963,792 |

| 106 | Thermo Fisher Scientific Inc. | 106,291 | $19,891,298 |

| 107 | Bank of Nova Scotia | 317,490 | $19,752,391 |

| 108 | EI du Pont de Nemours & Co. | 231,634 | $19,441,042 |

| 109 | Netflix Inc. | 109,761 | $19,176,344 |

| 110 | BHP Billiton Ltd. | 863,495 | $18,797,577 |

| 111 | PayPal Holdings Inc. | 302,882 | $18,681,762 |

| 112 | Unilever plc | 319,889 | $18,663,940 |

| 113 | Daimler AG | 255,724 | $18,660,862 |

| 114 | NIKE Inc. Class B | 352,939 | $18,638,709 |

| 115 | SoftBank Group Corp. | 228,315 | $18,587,402 |

| 116 | NextEra Energy Inc. | 122,727 | $18,471,641 |

| 117 | Australia & New Zealand Banking Group Ltd. | 785,456 | $18,386,656 |

| 118 | ING Groep NV | 1,035,357 | $18,378,594 |

| 119 | Costco Wholesale Corp. | 116,522 | $18,263,658 |

| 120 | Biogen Inc. | 57,635 | $18,244,936 |

| 121 | Caterpillar Inc. | 151,692 | $17,822,293 |

| 122 | Enbridge Inc. | 439,064 | $17,552,012 |

| 123 | American Express Co. | 202,696 | $17,452,126 |

| 124 | Chubb Ltd. | 122,100 | $17,267,382 |

| 125 | LVMH Moet Hennessy Louis Vuitton SE | 65,506 | $17,206,615 |

| 126 | National Australia Bank Ltd. | 714,061 | $17,167,613 |

| 127 | salesforce.com Inc. | 179,446 | $17,135,299 |

| 128 | Lowe's Cos. Inc. | 229,741 | $16,975,562 |

| 129 | American Tower Corp. | 112,996 | $16,729,058 |

| 130 | Colgate-Palmolive Co. | 229,141 | $16,415,661 |

| 131 | PNC Financial Services Group Inc. | 130,058 | $16,310,574 |

| 132 | Reckitt Benckiser Group plc | 171,387 | $16,252,493 |

| 133 | Canadian National Railway Co. | 200,496 | $16,251,616 |

| 134 | Prudential plc | 689,886 | $16,194,695 |

| 135 | Morgan Stanley | 352,224 | $16,026,192 |

| 136 | Mondelez International Inc. Class A | 390,327 | $15,870,696 |

| 137 | Industrial & Commercial Bank of China Ltd. | 21,083,245 | $15,843,485 |

| 138 | Duke Energy Corp. | 181,051 | $15,805,752 |

| 139 | Lloyds Banking Group plc | 19,124,840 | $15,764,621 |

| 140 | Banco Bilbao Vizcaya Argentaria SA | 1,780,329 | $15,753,943 |

| 141 | Rio Tinto plc | 323,300 | $15,703,315 |

| 142 | Hon Hai Precision Industry Co. Ltd. | 4,001,151 | $15,624,704 |

| 143 | China Mobile Ltd. | 1,465,361 | $15,551,562 |

| 144 | Taiwan Semiconductor Manufacturing Co. Ltd. | 2,148,000 | $15,460,230 |

| 145 | UBS Group AG | 924,350 | $15,230,418 |

| 146 | Deutsche Telekom AG | 837,031 | $15,137,810 |

| 147 | American International Group Inc. | 246,169 | $14,888,301 |

| 148 | Glencore plc | 3,123,245 | $14,555,870 |

| 149 | AXA SA | 501,661 | $14,545,588 |

| 150 | Bank of New York Mellon Corp. | 276,473 | $14,454,008 |

| 151 | ConocoPhillips | 329,563 | $14,388,721 |

| 152 | FedEx Corp. | 66,008 | $14,150,795 |

| 153 | Suncor Energy Inc. | 450,546 | $14,118,010 |

| 154 | General Dynamics Corp. | 69,795 | $14,053,223 |

| 155 | Raytheon Co. | 76,372 | $13,900,468 |

| 156 | Anthem Inc. | 70,749 | $13,869,634 |

| 157 | Aetna Inc. | 87,461 | $13,792,600 |

| 158 | BlackRock Inc. | 32,903 | $13,786,686 |

| 159 | Danaher Corp. | 161,217 | $13,448,722 |

| 160 | Sony Corp. | 338,700 | $13,401,796 |

| 161 | Monsanto Co. | 114,063 | $13,368,184 |

| 162 | Honda Motor Co. Ltd. | 476,541 | $13,347,926 |

| 163 | General Motors Co. | 364,096 | $13,304,068 |

| 164 | Sumitomo Mitsui Financial Group Inc. | 353,548 | $13,163,753 |

| 165 | EOG Resources Inc. | 154,839 | $13,159,767 |

| 166 | Simon Property Group Inc. | 83,498 | $13,096,661 |

| 167 | KDDI Corp. | 482,400 | $13,014,354 |

| 168 | Applied Materials Inc. | 288,212 | $13,004,125 |

| 169 | ASML Holding NV | 82,660 | $12,905,412 |

| 170 | Activision Blizzard Inc. | 196,763 | $12,899,782 |

| 171 | Kraft Heinz Co. | 159,240 | $12,858,630 |

| 172 | Dominion Energy Inc. | 161,594 | $12,728,759 |

| 173 | Automatic Data Processing Inc.: | 119,507 | $12,723,910 |

| 174 | Charles Schwab Corp. | 317,478 | $12,667,372 |

| 175 | TJX Cos. Inc. | 174,220 | $12,596,106 |

| 176 | Stryker Corp. | 89,071 | $12,591,967 |

| 177 | Southern Co. | 260,494 | $12,571,440 |

| 178 | CSL, Ltd. | 122,184 | $12,504,966 |

| 179 | Illinois Tool Works Inc. | 90,912 | $12,501,309 |

| 180 | Keyence Corp. | 23,966 | $12,494,858 |

| 181 | Enel SPA | 2,052,660 | $12,435,910 |

| 182 | Tesla Inc. | 34,894 | $12,418,775 |

| 183 | Telefonica SA | 1,145,960 | $12,363,537 |

| 184 | Occidental Petroleum Corp. | 205,080 | $12,243,276 |

| 185 | Cigna Corp. | 67,131 | $12,221,870 |

| 186 | UniCredit SPA | 598,654 | $12,208,381 |

| 187 | Airbus SE | 144,461 | $12,166,485 |

| 188 | Iberdrola SA | 1,474,250 | $12,062,593 |

| 189 | Bank of Montreal | 167,926 | $12,050,329 |

| 190 | Cie Financiere Richemont SA | 134,350 | $12,010,089 |

| 191 | adidas AG | 53,467 | $12,008,437 |

| 192 | Danone SA | 151,767 | $11,957,078 |

| 193 | Shire plc | 240,333 | $11,953,537 |

| 194 | Becton Dickinson and Co. | 59,754 | $11,917,338 |

| 195 | CSX Corp. | 236,576 | $11,876,115 |

| 196 | Northrop Grumman Corp. | 43,600 | $11,868,356 |

| 197 | ABB Ltd. | 509,241 | $11,783,025 |

| 198 | Housing Development Finance Corp. Ltd. | 423,063 | $11,764,019 |

| 199 | Crown Castle International Corp. | 108,271 | $11,740,907 |

| 200 | Takeda Pharmaceutical Co. Ltd. | 211,443 | $11,725,400 |

200位までの日本株

37位 トヨタ自動車(7203)

115位 ソフトバンク(9984)

160位 ソニー(6758)

162位 本田自動車(7267)

164位 三井住友ファイナンシャルグループ(8316)

167位 KDDI(9433)

200位 武田薬品工業(4502)

合計 7社がランクインしています.

さみしい結果と思いますがいかがでしょうか?

200位以下の日本株

残り 7,600銘柄を羅列するのは,さすがに気が引けるので銘柄名を抽出しておきます.

207位 みずほファイナンシャルグループ(8411)

219位 日本たばこ産業(2914)

230位 キヤノン(7751)

249位 信越化学工業(4063)

258位 任天堂(7974)

276位 JR東日本(9020)

278位 NTT(9432)

288位 日立製作所(6501)

294位 JR東海(9022)

297位 セブン&アイ(3382)

305位 花王(4452)

316位 NTTドコモ(9437)

317位 三菱電機(6503)

318位 三菱商事(8058)

319位 村田製作所(6981)

320位 パナソニック(6752)

344位 東京海上(8766)

349位 三井商事(8031)

353位 ブリヂストン(5108)

354位 アステラス製薬(4503)

369位 ダイキン工業(6367)

372位 伊藤忠商事(8001)

379位 コマツ(6301)

387位 大和ハウス(1925)

405位 デンソー(6902)

425位 HOYA(7741)

431位 東京エレクトロン(8035)

445位 SUBARU(7270)

449位 スズキ(7269)

451位 キリン(2503)

454位 京セラ(6971)

459位 オリックス(8591)

495位 クボタ(6326)

このランクですと,時価評価額がざっくり 6-8億円程度です.

VTによる株の買い付けや売りつけなどの行為は,該当する株価の上下動には余り影響がなさそうです.

もしVTの保有する銘柄全てが見てみたいかたは下のリンクからどうぞ.

Vanguard社の,VTのポートフォリオ一覧へ飛びます.

こぼれ話

三井住友ファイナンシャルグループ

日本名:三井住友ファイナンシャルグループ

英名:Sumitomo Mitusi Financial Group

JR東海の英語表記では

英名:Central Japan Railway Co.

キャノンではなくキヤノン

ブリジストンではなくブリヂストン

まとめ

VTの運用者が選ぶ日本株を調べてみました.

よく名の知れた大型企業が名を連ねています.

日本株購入の参考になりますか?